In late June 2022, the ATO finalised its ‘Protocol’ for taxpayers, and those acting for them, to claim ‘legal professional privilege’ (LPP) over the various kinds of communications it attaches to – which I’m covering in this article. This is an important topic, as such communications cannot be the subject of the Commissioner’s mandatory rights to get and access information. The passage of this protocol, to the point of being finalised has generated quite a bit of heat, which I’ve covered in this related TT Article. I’ve attached a link to this finalised protocol and embedded a ‘pdf’ copy of the finalised Protocol, for convenience (and as a record, should this cease to be available, for any reason, on the ATO’s website).

The finalised Protocol protests that it is ‘voluntary’ but asks taxpayers to adopt a ‘if not how not’ approach.

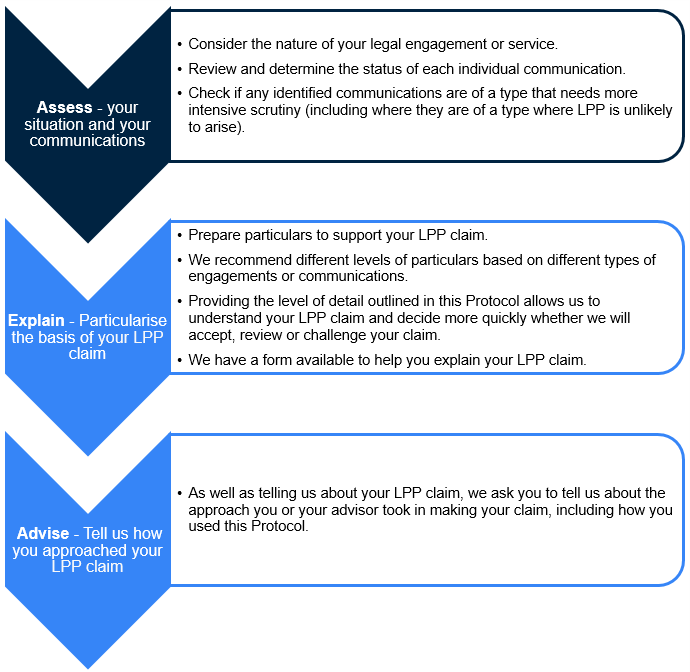

The following gives some idea of its thrust.

The ATO’s recommended approach

15. Our recommended approach contains three steps:

The heart of the Protocol’s requirement for providing them information is set out below.

35. We consider that providing the recommended particulars to us, of itself is unlikely to result in an unintended waiver of privilege and we will generally not seek production of the underlying communication on this basis. In the unlikely event that privilege is inadvertently waived, this is likely to operate as a limited waiver as against the Commissioner but not as against the rest of the world. There may be some exceptional or limited situations where you form the view that providing some of the particulars in paragraphs 38 to 40 of this Protocol could amount to a waiver. To the extent that any particular would reveal the content of the advice you received, we do not expect it to be provided. We encourage you to consider seeking legal advice if you believe there is a risk of waiver of privilege.

Particulars

38. We recommend that you provide the following:

(a) a Document ID, file name or reference number

(b) the name of privilege holder(s)

(c) the date the document was prepared or communication was made

(d) the number of pages in the document

(e) a title or subject line of the communication, except to the extent that disclosure of the title or subject line would also disclose the content of legal advice

(f) the form of the communication; for example, email, letter or file note

(g) the type of document; for example, advice, contract or invoice

(h) the identity and role of each person between whom the document or communication is made

(i) author(s) and, if different, sender (name, position, organisation), and

(ii) all people who have received the document (name, position, organisation); if the document is an email, this will include those in the ‘cc’ and ‘bcc’ fields

(i) whether the document is a copy

(j) the dominant purpose for which the communication was made (see the examples in Addendum 3 to this Protocol) but not to the extent this discloses the content of legal advice(k) the legal issue being advised upon or for which the advice is being sought, except to the extent that disclosure of the legal issue would also disclose the content of legal advice(l) whether the communication was forwarded; if so, provide an explanation of

-

-

-

-

- (i) the purpose of forwarding it

- (ii) how confidentiality in the communication was maintained, and

- (iii) how you assured yourself that privilege was not lost

-

-

-

(m) whether LPP is claimed in full or in part, and(n) if there are attachments to the document, whether LPP is being claimed over the attachment(s); if yes

-

-

-

-

- (i) identify the relevant Document ID or number of the attachments; for example, Attachment to document X, and

- (ii) provide the particulars in this paragraph for the attachment(s).

-

-

-

The delivered information is ‘secret’ – the Protocol says – that is it will be ‘protected information’, however, taxpayers ought know the limitations to that assurance set out on Div 355 of the TAA53. The Commissioner can, and can be compelled to share this information, with various other agencies and with other taxpayers, on the occasions set out in that Division (see para 36 of the Protocol below.

36. Particulars provided to us in support of an LPP claim will be ‘protected information’ for the purposes of Division 355 of Schedule 1 to the Taxation Administration Act 1953 (TAA53) and will not be disclosed, except as required or permitted by law.

It is also protests (now) that the ATO does not expect you to waive privilege – studded here and there, including qualifications to previously requested details, such as the most contentious – the ‘title or subject line’ (see Particular (e) above).

AGS advice on taxpayers potentially waiving privilege, if they complied with the draft notice, was sought by the Commissioner and has been included as ‘Addendum 4’ at the end of the finalised Protocol. It may well be the source of the finalised protocol becoming more visibly ‘voluntary’ and inserting qualifications making it clear that the information sought has appropriate ‘carve-outs’ for information that would be privileged (see TT article about the Compendium on it’s consolidation, which draws particular attention to item 4 in the Compendium, and changes made to paragraphs 11, 34 & 35 of the finalised Protocol).

Addendum 4 – Australian Government Solicitor advice

The following is an advice obtained by the ATO from the AGS in relation to written feedback on waiver (the advice has been edited to remove confidential information).

Prepared for Australian Taxation Office

Nicholas Shizas, ATO General Counsel

Our ref:

21008820

9 May 2022

ATO draft LPP Protocol – written feedback on waiver

1. You have requested advice about written feedback the Commissioner has received on the draft Legal Professional Privilege Protocol which suggests that providing particulars of legal professional privilege claims, in accordance with the Protocol’s recommendations, may result in a waiver of privilege.

Summary

| Does the provision of the recommended particulars in the draft Protocol give rise to waiver of LPP, having regard to the purpose of the Protocol and the feedback received from the public consultation to date? |

2. We expect that in the majority of cases there will be a low risk of waiver of privilege where the particulars of a privilege claim are provided consistently with the recommendations in the Protocol. However, this will depend on the circumstance of each case.

3. In cases where there are legitimate concerns that disclosure of certain information within particulars might result in a waiver of privilege, that information can be withheld. The provision of particulars under the Protocol is voluntary.

4. In the unlikely event that privilege is inadvertently waived by voluntary provision of the recommended particulars to the Commissioner, this is likely to operate as a limited waiver and preserve the privilege-holder’s ability to enforce their claim against the world at large.

Next Steps

5. Please contact us if you would like to discuss this advice.

Reasons

| Does the provision of the recommended particulars in the draft Protocol give rise to waiver of LPP, having regard to the purpose of the Protocol and the feedback received from the public consultation to date? |

Privilege claimants will ultimately bear the onus of making out their claims

6. A useful starting point, and important context in which this question arises, is that it is usually not sufficient for a party claiming legal professional privilege merely to assert that claim without exposing the facts on which the claim is based.

7. This is clearly established in the curial context, where the party claiming privilege bears the onus of making out the claim. This onus can be discharged by leading evidence as to the circumstances or context in which the communications or documents were made, and by reference to the nature of the documents themselves. Merely asserting that privilege applies or reciting a verbal formula will not suffice.

8. ….

Finalised LPP Protocol (June 2022)

https://www.ato.gov.au/law/view/document?DocID=SGM/LPP-FINAL

Loading...

Loading...

[Tax Month – June 2022 – Previous Month, 4.7.22]